tucson sales tax calculator

The South Tucson Arizona sales tax is 1000 consisting of 560 Arizona state sales tax and 440 South Tucson local sales taxesThe local sales tax consists of a 050 county sales tax. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience.

Do This To Save 16 On Every Marijuana Purchase In Arizona

Tumacacori AZ Sales Tax Rate.

. South Tucson AZ Sales Tax Rate. Price of Accessories Additions Trade-In Value. Multiply the vehicle price.

City of Tucson Notice to Taxpayers Tax Rate Increase Flyer City of Tucson. How to Calculate Arizona Sales Tax on a Car. Counties and Tucson plus thousands of special purpose.

In unincorporated Pima County where the sales tax is 61 percent that would only be 9150. The County sales tax. Free sales tax calculator tool to estimate total amounts.

When combined with the state rate each county holds the following total. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. This is the total of state county and city sales tax rates. Therefore more accurate rates are determined based on street address.

The latest sales tax rate for South Tucson AZ. There are often multiple tax rates per ZIP code county and city. Use our simple sales tax calculator to work out how much sales tax you should charge your clients.

Tax Paid Out of State. The Arizona sales tax rate is currently. Method to calculate Old Tucson sales tax in 2021.

Tucson Sales Tax Rates for 2022. There is no applicable special tax. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax.

The sales tax jurisdiction. To calculate the sales tax on an. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. The December 2020 total local sales tax rate was also 8700. As of 2020 the current county sales tax rates range from 025 to 2.

Method to calculate Tucson sales tax in 2021. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Tucson in Arizona has a tax rate of 86 for 2022 this includes the Arizona Sales Tax Rate. There are three primary phases in taxing real estate ie setting levy rates appraising property market worth and receiving receipts.

The minimum is 56. You can calculate the sales and use tax rate in your area by. City and County Additions.

Thats why the sales tax rate on a retail sale in one town can differ from one located in a different town even if its close by. This rate includes any state county city and local sales taxes. The current total local sales tax rate in Tucson AZ is 8700.

The Avalara Tax Changes 2022 Midyear Update is. United States Tax ID Number Business License Online Application. The minimum combined 2022 sales tax rate for Tucson Arizona is.

Method to calculate New Tucson sales tax in 2021. Business License and Tax Information opens a new window tucsonazgov Find the. Sales tax in Tucson Arizona is currently 86.

Would you drive an extra mile or two for 3750. Arizona has a 56 statewide sales tax rate but also. 2020 rates included for use while preparing your income tax deduction.

Input the amount and the sales tax rate select whether to include or exclude sales tax.

2021 Arizona Car Sales Tax Calculator Valley Chevy

How To Calculate Sales Tax For Your Online Store

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Property Tax Calculator Casaplorer

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

How To Calculate Cannabis Taxes At Your Dispensary

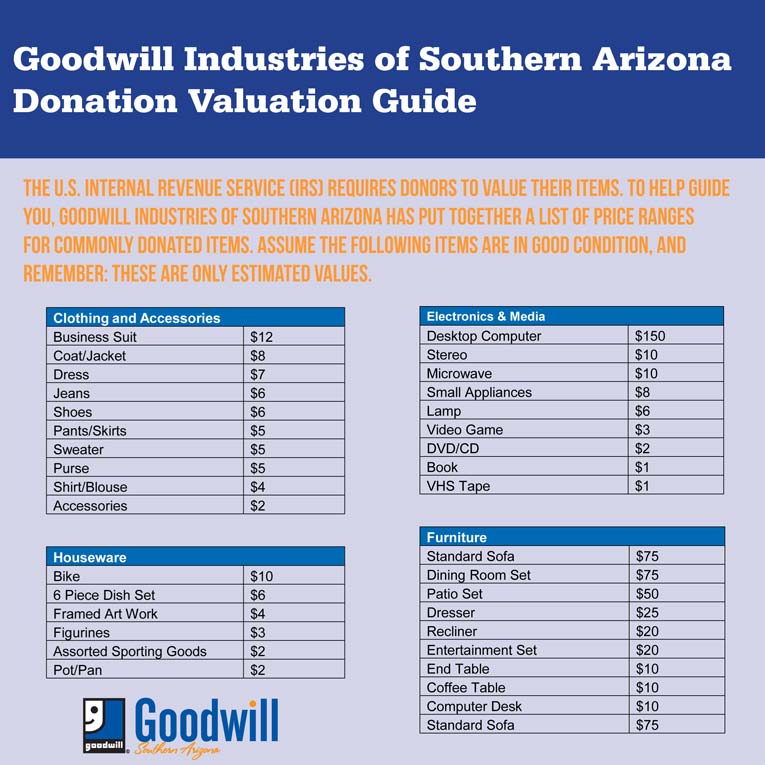

Estimate The Value Of Your Donation Goodwill Industries Of Southern Arizona

How To Calculate Sales Tax For Your Online Store

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

Property Tax Calculator Casaplorer

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

A Complete Guide On Car Sales Tax By State Shift

Property Taxes In Arizona Lexology

Arizona Sales Tax Rates By City County 2022

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Small Business Guide Truic

Arizona Income Tax Calculator Smartasset

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 75 Free To Download And Print Tax Printables Sales Tax Tax